《经济学人》文章(2019年10月18日—25日)

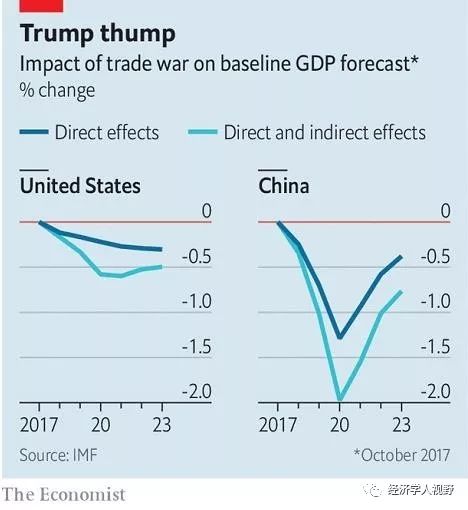

国际货币基金组织(IMF)再次下调了对全球经济的预测。根据其预测,贸易战对全球经济的直接影响不大,但是间接影响很大。到2020年,对美国GDP造成0.6%的损害,对中国GDP造成2%的损害。

10月15日,美国总统特朗普在白宫接见了冰上曲棍球冠军队——圣路易斯·布鲁斯(St Louis Blues)。之后,他一厢情愿地回忆他自己最近获得的胜利:上周与中国的临时贸易协议。简而言之,如果中国承诺购买价值数十亿美元的美国农产品,美国将不会进一步对中国进口产品征收惩罚性关税。那么,总共是多少亿呢?特朗普强调说:“这是一个很大的数字。我说‘70亿怎么样?’…我的人民说,‘好吧,20亿。’我说,‘不,50亿。’”

那么,这个经过仔细讨论的数字会落地吗?中国不愿为此付出代价,也不想剥夺其他友好供应商的风俗习惯。它还希望美国不仅承诺不再征收新关税,还要开始取消现有关税。然而,一项协议在正式成文之前都有可能取消,更不用说还需要两国领导人在下个月圣地亚哥举行的亚太经济合作论坛上签署了。

因而,这种不可预测性是一个大问题。国际货币基金组织再次下调了对全球增长的预测,其首席经济学家吉塔·戈皮纳特(Gita Gopinath)本周表示,不仅是高关税,而且“长期的贸易政策不确定性”正在损害世界经济。基金组织指出:“制造类企业对长期支出变得更加谨慎,在设备和机械的采购上更加节制。”贸易战的迷雾正在抑制投资支出。而且,由于机械、设备和其他资本货物通常是进口的,疲软的投资进一步损害了贸易。国际货币基金组织现在预测,今年全球经济将仅增长3%,而去年是3.6%。这将是自全球金融危机之后,近十年来最低的增速。

今年,预计美国和欧元区的增长将比7月份(贸易紧张局势升级之前)的预期更低。印度的前景已非常暗淡:现在预期增长为6.1%,而不是几个月前的7%。而对中国2020年预期增长不足6%,30年来首次低于这个数字。

毫不奇怪,国际货币基金组织大幅削减了对香港经济增长的预测。现在,香港预期增长仅为0.3%,而在4月份,那时经济前景还未因“催泪弹的雾霾”而受到损害,预期增长是2.7%。动荡也可能危及中美之间脆弱的贸易休战协议。10月15日,美国众议院通过了一项举措,要求美国每年评估香港的自治权,并对侵犯其自治权的官员进行制裁。而中国一向反感外来干预。

国际货币基金组织的经济学家已经在勇敢地量化评估,如果特朗普总统所谓的协议失败了,那么贸易战对世界经济的损害有多大。而令人惊讶的是,直接影响是不大的。与贸易战未爆发的世界相比,明年已经实行的关税和即将征收的关税可能会使美国的GDP下降0.2%。但是,间接影响很大:商业信心减弱,生产力和金融市场风险偏好降低。到2020年,这些将对美国GDP造成0.6%的损害,对中国GDP造成2%的损害。这些百分率是很小,但要考虑到经济体量很大。如果IMF对的话,那么一场悬而未决的贸易战仅在明年就可能使美国损失约1250亿美元。中国付出的代价可能超过3000亿美元(按市场汇率计算)。这些确实是大数字。

附原文:

Foggy outlook

How thetwists and turns of the trade war are hurting growth?

The IMFdowngrades its forecasts for the global economy. Again

Oct17th 2019 | HONG KONG

AFTERWELCOMING the St Louis Blues, a championship-winning ice-hockey team, to theWhite House on October 15th, President Donald Trump fondly recalled a recenttriumph of his own: last week’s tentative trade deal with China. Simply put,America will impose no further punitive tariffs on Chinese imports if Chinapromises to buy American farm goods worth billions of dollars. How manybillions? “It’s very big numbers,” Mr Trump emphasised. “I said, ‘Ask for70.’…My people said, ‘All right, make it 20.’ I said, ‘No, make it 50.’”

Willthis carefully calibrated amount ever materialise? China does not want to payover the odds or deprive other, friendlier suppliers of its custom. It alsowants America to go beyond promising no new tariffs and to start removingexisting ones. The deal may unravel before it is written down, let alone signedby the two countries’ leaders next month at the Asia-Pacific EconomicCo-operation forum in Santiago.

Thatunpredictability is a problem. Not just higher tariffs but “prolongedtrade-policy uncertainty” are damaging the world economy, said Gita Gopinath,the IMF’s chief economist, this week as the fund again cut its forecast forglobal growth. “Manufacturing firms have become more cautious about long-rangespending and have held back on equipment and machinery purchases,” the fundnotes. The fog of trade war is depressing investment spending. And becausemachinery, equipment and other capital goods are often imported, weakinvestment spending is further hurting trade. The IMF now expects the worldeconomy to expand by just 3% this year, compared with 3.6% last year. Thatwould be the slowest rate in the decade since the global financial crisis.

BothAmerica and the euro zone are expected to grow more slowly this year than thefund had envisaged in July, before trade tensions escalated. India’s prospectshave dimmed sharply: it is forecast to grow by 6.1% rather than the 7% expectedonly months ago. And in 2020 China is now projected to expand by less than 6%for the first time in 30 years.

Thefund has, unsurprisingly, slashed its forecast for Hong Kong. The city is nowexpected to grow by only 0.3%, compared with the 2.7% foreseen in April, beforeits economic prospects vanished in a cloud of tear-gas. The unrest could also jeopardisethe fragile trade truce between America and China. On October 15th the House ofRepresentatives passed a measure enjoining America to assess Hong Kong’sautonomy annually and sanction officials who violate it. China reacted angrilyto what it describes as meddling in its affairs.

TheIMF’s economists have valiantly tried to quantify the damage to the worldeconomy from the trade war if Mr Trump’s putative deal falls apart. The directimpact is surprisingly modest. The tariffs already in place and in the pipelinecould reduce America’s GDP by just over 0.2% next year, compared with a worldin which the trade war had never started (see chart). More harmful are indirecteffects: weaker business confidence, productivity and risk-appetite on financialmarkets. These bring the damage to almost 0.6% of America’s GDP in 2020. Thedamage to China would be almost 2% of its GDP. These are small percentages—butof vast economies. If the IMF is right, an unresolved trade war could costAmerica roughly $125bn of forgone output next year alone. The cost to Chinacould exceed $300bn (at market exchange rates). Big numbers indeed.

https://www.economist.com/finance-and-economics/2019/10/17/how-the-twists-and-turns-of-the-trade-war-are-hurting-growth