CNN

Ever since last year, nothing has grabbed economists' attention as much as the whipsawing (两头吃亏)evolution of the US-China trade war. Just last week, the IMF downgraded its global growth forecast for 2020, citing trade and geopolitical tensions.

自去年以来,没有什么比中美贸易战更能吸引经济学家的注意力了。就在上周,国际货币基金组织(IMF)以贸易和地缘政治紧张为由,下调了对2020年全球经济增长的预期。但美国经济周期研究所(Economic Cycle Research Institute)认为,经济预测者误解了当前全球经济放缓的主要原因。

But economic forecasters are misunderstanding the primary cause of the current global slowdown, which means that they'll also miss what's coming next.

经济周期研究所表示,现在看来,很明显全球实际工业生产增速在2017年底开始放缓。换句话说,全球工业总产值的同比增长速度在2017年底开始持续下降。

In hindsight(后知后觉),it's clear that actual global industrial production growth started slowing at the end of 2017. In other words, the year-over-year pace of increase in the world's total industrial output began a sustained decline in late 2017. That's the definition of a global industrial slowdown.

2017年末起全球实际的工业生产增长开始变慢,也就是说,世界总工业产出年均增速在2017年末持续下降,即全球工业发展变缓。

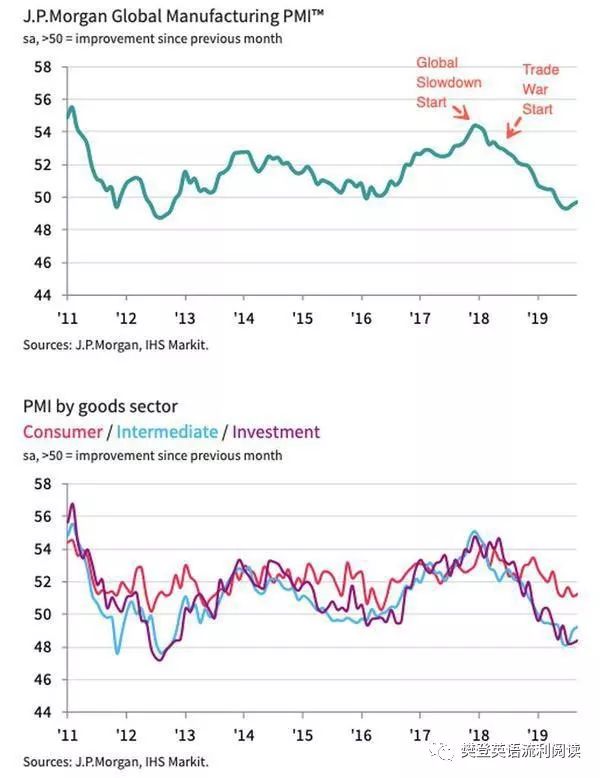

Most analysts focus on the global purchasing managers' index (PMI)

采购经理指数 data for their read on global growth because it's published each month about a month and a half before the actual production data. While the global PMI generally has a positive correlation (关联)with global industrial production growth, it doesn't measure actual industrial production, as it's based on a survey of purchasing executives about conditions facing their companies. It's really a proxy (代名词)for industrial production growth, which measures real output for all companies within the manufacturing, mining and utilities industries.(制造业、矿业以及公共事业产业)

大多数分析师关注全球采购经理人指数(PMI)数据以了解全球经济增长情况,因为该数据每月发布一次,比实际生产数据早一个半月左右。尽管全球PMI数据通常与全球工业生产增长呈正相关,但它并不能衡量实际的工业生产,因为它是基于对采购经理人对其公司所面临状况的调查的结果。它实际上是工业生产增长的一个指标,衡量制造业、采矿业和公用事业行业所有公司的实际产出。

In this case, while the global manufacturing PMI also started easing at the end of 2017, its decline didn't become evident until a few months into 2018, when the sustained nature of the downturn (低迷时期)became increasingly difficult to dismiss as meaningless "noise." Coincidentally, that's just about when President Trump began his trade war, slapping tariffs on washing machines and steel and aluminum imports. Because the trade war was front and center前沿和中心,economists thought it was to blame for the drop in PMI and global industrial growth.

在这种情况下,虽然全球制造业PMI在2017年底也开始下降,但直到进入2018年的几个月,这种下降的趋势才变得明显起来,当时人们越来越难以将经济低迷的持续性视为毫无意义的“噪音”。巧合的是,就在那时,美国总统特朗普开始发动他的贸易战,对其他国家的洗衣机、钢铁和铝等进口商品加征关税。由于贸易战处于风口浪尖,经济学家认为它是PMI下降和全球工业增长放缓的罪魁祸首。

Obviously, the trade war has hurt global growth. But it's important to understand that it didn't cause the global slowdown. We know this because growth in the Economic Cycle Research Institute's leading indexes of global manufacturing — designed to foretell directional changes in both the global industrial production growth cycle and the global manufacturing PMI — started heading lower in mid-2017, well before the trade war started. So the cyclical downturn (周期性低迷 )in global industrial growth was already taking shape in 2017. The trade war — starting up in 2018 — just piled onto that downturn.

显然,贸易战损害了全球增长。经济周期研究所的数据显示,全球制造业领先指数(旨在预测全球工业生产增长周期和全球制造业PMI的方向变化)在2017年中期(即贸易战开始之前)就已经开始走低。因此,全球工业增长的周期性下滑已在2017年形成。而这场始于2018年的贸易战加剧了这种衰退。

Most believe that economic growth just hums along until some identifiable cause makes it veer away from its "normal" course. In contrast, our research reveals an underlying economic cycle that makes economic growth swing from strength to weakness and back again. When that happens, people tend to credit赞扬 or blame 谴责salient 突出的events, furnishing easily understood narratives to explain cyclical swings 摇摆 caused primarily by the deep drivers of economic cycles. But, in reality, it was these underlying drivers of economic cycles — including higher interest rates and oil prices — that induced global industrial growth to start ebbing in late 2017 before there was any trade war.

大多数人认为,经济增长只会一直持续到某些可确定的原因使它偏离其“正常”路线。相比之下,经济周期研究所的研究揭示了一个潜在的经济周期,使经济增长从强到弱,然后再循环往复。发生这种情况时,人们倾向于将事件归功于或归咎于重大事件,提供易于理解的叙述来解释主要由经济周期的深层驱动因素引起的周期性波动。但是,实际上,正是这些经济周期的潜在驱动力(包括更高的利率和石油价格)促使全球工业增长在贸易战之前就已经开始减弱。

The consensus view usually reflects what's already happened, meaning that it's also reliably behind the curve. The IMF's global GDP growth forecasts have always been downgraded whenever actual global GDP growth has downshifted from the previous year. The same pattern holds when growth sees a cyclical upturn. A case in point is 2016-2017, when growth began turning up before President Trump was elected.

IMF的全球GDP增长预测,总是在实际全球GDP增速较上年下降时被下调。当经济增长出现周期性好转时,同样会被上调。这样就存在着滞后性。

Such moves are commonly credited to or blamed on prominent 重要的people and events.

Make no mistake, the US-China trade war, in particular, is already having a profound impact on the world economy, spurring a long-term restructuring of supply chains, for example. But underlying cyclical forces can turn up regardless of what presidents Trump and Xi Jinping of China decide, and when.

毫无疑问,尤其是中美贸易战已经对世界经济产生了深远影响,例如,推动了供应链的长期重组。

Looking ahead, that means at some point global growth can revive even without the trade war ending. Even so, the recovery will be credited, as always, to the prominent events of the time. ?

往前看,也意味着即使贸易战没有结束,经济增长可能在某个时间点复苏。哪怕如此,按照以往,也会归因于时代的重要事件的影响。